The Real Technical Split: Pre- vs. Post-Purchase Upsells

A pre-purchase upsell is an offer shown before a customer pays, modifying the current shopping cart. A post-purchase upsell is an offer shown after a customer completes payment, creating a new, separate transaction. The main difference is the timing of the offer relative to the initial payment and its effect on the order.

On the surface, it seems obvious. Pre-purchase happens before the credit card is charged. Post-purchase happens after. Simple, right? But that single difference in timing isn’t just a detail; it’s a chasm that dictates the entire technical architecture, the risk profile, and the customer’s sanity.

It’s one thing to know they’re different. It’s another to really get the architectural and psychological gap between these two strategies. They’re both trying to jack up the order value, sure, but how they do it, the APIs they hit, the session state they manipulate, and the way they either protect or jeopardize your core conversion rate, is a world apart. This is the breakdown for anyone, from engineer to marketer, who needs to understand the machinery before they start sketching out funnels.

Okay, Let’s Nail Down the Lingo First

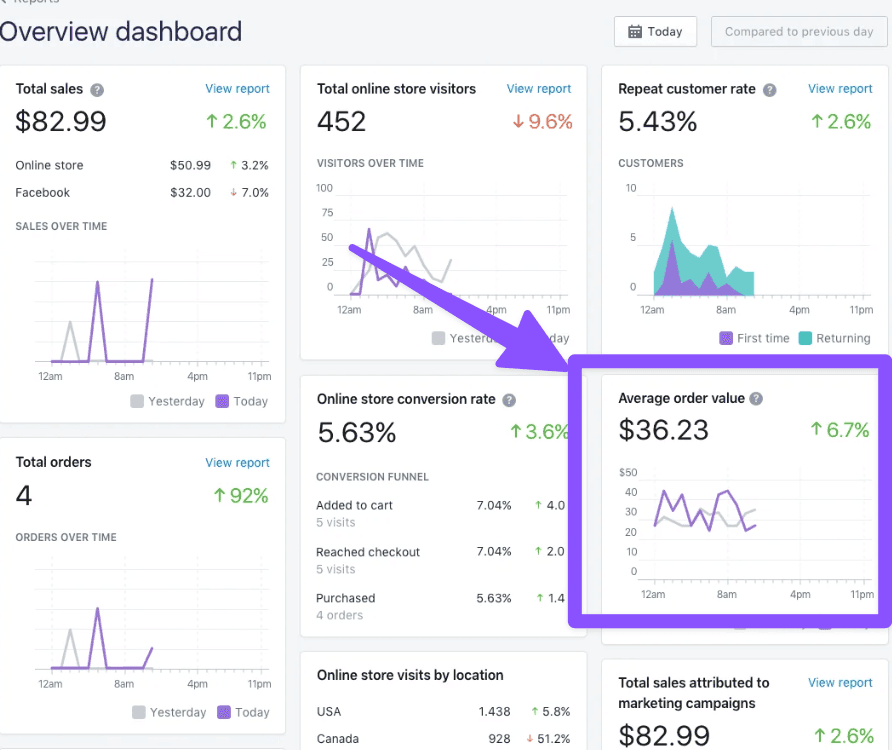

Before we start talking AJAX and payment tokenization, we need a shared vocabulary. An “upsell” is just a strategy to get a customer to spend more, either by upgrading their item or adding more stuff to the order. The whole point is to boost Average Order Value (AOV) and get more juice from the traffic you’ve already paid for.

That timing, pre- or post-payment, is the pivot point that forks the entire technical implementation.

What is a Pre-Purchase Upsell?

This is any offer you show a customer before they’ve clicked that final “Confirm Order” button.

These offers are all about mutating the current shopping cart while the customer is in that precarious, high-abandonment checkout mindset. You’ve seen them everywhere: on product pages, as cart page suggestions, or in those modals that pop up the second you add an item. From a technical standpoint, the whole game is dynamically changing the cart object’s state before the transaction is even attempted. This comes with a huge, flashing neon sign that says FRICTION. You are interrupting the most sacred part of the funnel.

And the Post-Purchase Upsell?

This is the polar opposite. The offer is only presented after the initial transaction is 100% complete and the money is in the bank. The customer has entered their payment, their shipping, confirmed the order, and landed on what is typically the “thank you” page.

The technical elegance here is its killer feature. It works by leveraging tokenized payment info from gateways like Stripe or Shopify Payments. So instead of making the customer re-enter their card details, they can accept the new offer with a single click. It’s a frictionless “yes.” This design completely eliminates the risk of abandoning the original cart because that sale is already locked in.

Why Timing Changes Absolutely Everything

This isn’t a minor point. The timing dictates the entire risk profile.

- Pre-purchase is a pure gamble. Every single offer is a potential distraction, a moment of confusion that could nuke the original sale you were about to close.

- Post-purchase operates in a zero-risk environment, at least for that primary order. The first transaction is immutable. It’s done. This lets you be bolder with your offers because the customer is coasting on a “buyer’s high” without the pressure of completing their main purchase.

This one distinction cascades down into everything else: the UI, the types of products you can sanely offer, and the metrics you obsess over.

The Pre-Purchase Playbook: A Deep Dive

Pre-purchase is the old guard. It’s about fattening up the cart before the final buzzer. Success here is a tightrope walk between relevance and not being incredibly annoying. Get it wrong, and you’re actively paying to lower your conversion rate.

The Technical Mechanics

Under the hood, this is all about session-based cart mutation. When a customer accepts an offer, your backend needs to perform a quick, delicate dance.

- First, identify the new product variant or item.

- Then, you have to add it to the cart, or in trickier cases, replace an existing line item with its upgraded version.

- The cart subtotal, taxes, and shipping costs all have to be recalculated instantly. (This is a nightmare for tax calculation if you’re not careful, especially with complex shipping tiers).

- Your frontend UI has to update to reflect this new state without a full page reload. Nobody will tolerate that.

In practice, this is almost always handled via asynchronous JavaScript (AJAX) hitting an endpoint, on Shopify, for instance, you’re talking to the Cart API, to manipulate the cart object. The goal is a seamless update, but it’s fragile.

Implementation Methods and Placement

Where you stick these things matters. A lot.

- On the Product Page: This is your earliest shot. Think bundles (“Buy the camera, get 10% off this lens”). It feels integrated.

- In-Cart Modals: The classic “add-to-cart” trigger. You add a laptop, a pop-up offers a sleeve. It’s direct, but man, it can feel intrusive.

- On the Cart Page: This is a pretty natural spot. The customer is already reviewing their order, so suggesting batteries or an extended warranty makes sense.

- During Checkout: The highest-risk territory. Some platforms (like Shopify Plus) let you modify the checkout, but you are playing with fire. The user’s focus is a laser beam on finishing; any distraction is a potential abandonment.

The Trade-Offs: A Technical Breakdown

The Good:

- A direct lift in AOV for that specific transaction.

- Consolidated shipping is a big one. It’s all one order, one box. Simpler logistics.

- You have the customer’s full attention.

The Bad:

- Cart Abandonment. This is the monster under the bed. Any friction, any confusion, any “what is this pop-up?” moment, and they’re gone.

- Lower Conversion Rates. These just don’t convert as well as post-purchase offers. It’s an interruption, not an enhancement.

- Bad CX. An irrelevant or aggressive offer feels cheap and can erode brand trust.

- Technical Overhead. Getting this right with a slick UI and smart relevance rules is more complex than a static checkout flow.

The Post-Purchase Playbook: A Deep Dive

Post-purchase is the modern approach, and it’s exploding for a reason. Its genius is in its core principle: secure the initial sale first. It capitalizes on the peak moment of trust—right after they’ve bought from you, to make another, irresistible offer.

The “Magic” Behind It: Tokenization

The architecture is what makes this so safe and powerful. The key thing to understand is payment tokenization.

When that first purchase goes through, your payment gateway, Stripe, Braintree, Shopify Payments, whatever, doesn’t just process the charge. It creates a secure, single-use (or sometimes multi-use) token that represents the customer’s payment details without exposing the raw card number.

This token is the entire key to the kingdom.

- One-Click Acceptance: The post-purchase offer page is brutally simple. A product, an offer, a big “Add to My Order” button. When they click it, your application simply tells the payment gateway, “Hey, use that token from 30 seconds ago to run this second charge.”

- Zero-Friction: No re-entering credit card numbers. No re-entering shipping info. This is the single biggest reason for its ridiculously high conversion rates.

- Immutable Original Order: If they click “No thanks,” who cares? The original sale is already complete and un-touched. You’ve already won.

- Simplified Fulfillment… usually. Most modern platforms and apps are smart enough to automatically merge the post-purchase item into the original order. So for your fulfillment team, it just looks like a single order with an extra line item. The gotcha here is that this depends on your specific OMS or ERP integration; some older systems might see them as two separate orders, which can be a headache.

Funnels: It’s Not Just One Offer

A single offer is good. A sequence is better. This is where the concept of funnels comes in.

- Offer Chaining: If they accept the first upsell (a camera case), you can immediately hit them with a second one (a lens cleaning kit).

- Downsells: This is the really clever part. If a customer rejects the main upsell (a $50 accessory), don’t just give up. Immediately present them with a “downsell”—a lower-priced, easier “yes” ($15 memory card). It’s your second bite at the apple.

Stop Thinking AOV, Start Thinking CLV

Let me correct a common misconception. Pre-purchase is a pure AOV play. Post-purchase is different. Well, yes, it technically increases the total value of that session, but its real power is the impact on Customer Lifetime Value (CLV). A smooth, one-click post-purchase experience feels like great service. It trains your customers to see your brand as one that provides value even after the sale, which builds loyalty.

Head-to-Head: The Metrics That Matter

The timing difference creates wildly different performance profiles.

| Aspect | Pre-Purchase Upsell | Post-Purchase Upsell |

|---|---|---|

| Offer Timing | Before payment. High risk. | After payment is secured. Zero risk. |

| Impact on Sale | High chance of distracting and causing cart abandonment. | Absolutely zero risk to the original sale. It’s done. |

| Conversion Rate | Typically very low. Often in the low single digits. | Significantly higher. Industry averages hover around 10%, which is huge. |

| Customer Experience | Can feel like an interruption or a desperate cash grab. | Feels more like a personalized, bonus offer. Frictionless. |

| Core Metric | Average Order Value (AOV). | Total Revenue Per Session -> Customer Lifetime Value (CLV). |

Source: Synthesized from industry reports and best practices from platforms like Shopify, Rebuy, etc.

AOV vs. Total Revenue… They Aren’t The Same

This is a subtle but critical distinction.

- A pre-purchase upsell inflates the AOV of a single order.

- A post-purchase upsell increases the total revenue per customer session. In reality, it’s a second, linked transaction… but to your analytics and fulfillment, it should feel like one bigger order.

Focusing only on AOV is a trap. A pre-purchase offer might bump your AOV for the few who convert, but if it tanks your overall conversion rate by scaring people away, you’ve achieved a net loss in total revenue. Post-purchase protects that baseline revenue and only builds on top of it.

Advanced Plays & Hybrid Models

Once you get the basics, you can get sophisticated.

AI & Dynamic Offers

Instead of rigid “if this, then that” rules, modern systems use machine learning to generate offers in real-time. They look at browsing history, past purchases, and what similar customers bought to predict the single best offer for that specific person at that specific moment. This is where tools like Rebuy really shine.

Hybrid Funnels: The Best of Both

The real pro move isn’t picking one; it’s using them together intelligently. A smart hybrid funnel might look like this:

- Gentle Pre-Purchase: A non-intrusive bundle on the product page. Low risk.

- Clean Checkout: Do NOT interrupt the actual checkout flow itself. Let them pay.

- Main Post-Purchase Upsell: Hit them with your primary one-click offer on the thank you page. This is your heavy hitter.

- Post-Purchase Downsell: If they say no, offer the lower-cost alternative.

This layered approach maximizes opportunity while managing risk at each stage.

A Quick Word on SEO

Watch out. How you implement these, especially pre-purchase pop-ups, can have real SEO consequences.

- Intrusive Interstitials: Google’s mobile-first index hates pop-ups that obscure the main content on page load.

- Layout Shift (CLS): Dynamically loading offers can make your page content jump around, which will murder your Core Web Vitals score for Cumulative Layout Shift. This is a real ranking factor now.

- Page Speed: Heavy recommendation scripts add latency.

A Practical Guide for Shopify

Shopify’s app ecosystem makes this incredibly accessible.

Choosing the Right App

This is your most important decision. You’re looking for a few key things:

- True one-click post-purchase functionality that integrates with Shopify Payments.

- A visual funnel builder to chain upsells and downsells.

- Deep targeting rules—triggering funnels based on cart contents, order value, customer tags, etc.

- And obviously, solid analytics.

The big players are Rebuy (amazing for AI personalization), AfterSell (super focused on the post-purchase flow), and Zipify OCU (one of the OGs in the space).

Setting Up a Post-Purchase Funnel (The Concept)

- Install & Connect: Install the app, grant it permissions to talk to your payment gateway.

- Create a Funnel: Give it a sane name, like “Camera Body -> Lens Upsell.”

- Set the Trigger: The crucial step. Tell the app to fire this funnel only when a specific product (the camera body) is in the completed order.

- Build the Upsell Offer: Design the offer page. Select the lens as the upsell product. Write some good copy, maybe add a slight discount.

- Build the Downsell: Configure the funnel to offer a cheaper memory card if they decline the expensive lens.

- Activate & Watch: Turn it on and obsess over the analytics dashboard. Tweak based on the data.

Conclusion: So, Which One is Right?

The technical and strategic line is drawn right at the moment of payment. Pre-purchase risks the sale to increase its value. Post-purchase secures the sale first, then adds value with zero risk.

For the vast majority of stores, especially those on a platform like Shopify, the post-purchase upsell is the clear winner to start with. Period. Its zero-risk nature protects your core conversion rate, while the frictionless one-click experience provides an incredibly potent and reliable new revenue stream.

As you mature, a hybrid strategy will likely yield the best results. But always, always let the data, not your gut, guide the decisions.

Common FAQs

Review the common questions we get asked.

Seriously, how much does a pre-purchase offer really hurt the user experience?

It can be brutal. A badly timed, irrelevant pre-purchase pop-up feels like a pushy salesperson blocking the aisle. A post-purchase offer is more like the cashier helpfully asking if you need batteries for the thing you just bought. The psychological state of the customer is completely different.

If I’m paranoid about my conversion rate, which one do I use?

Post-purchase. It’s not even a debate. Since the original order is 100% complete before the offer is ever shown, there is literally zero risk of the upsell causing them to abandon their initial cart. It’s the safest way to add revenue.

What’s the real difference in the types of offers I can make?

With pre-purchase, you have to stay hyper-relevant to what’s in the cart to avoid confusing the user. With post-purchase, you have so much more freedom. The initial mission is accomplished, so you can be bolder—introduce new product categories, offer higher-ticket items, sell a subscription. The risk of derailing their original intent is gone.

How does this actually hit the books? Is one AOV and one just… revenue?

Think of it like this: pre-purchase tries to make the one check bigger before it’s written. Post-purchase lets the customer write the first check, then immediately asks if they want to write a second, smaller one. While your platform might roll them into a single order for reporting and fulfillment, they are technically two separate transactions from a payment gateway perspective. So yes, pre-purchase directly impacts AOV, while post-purchase boosts total revenue per session and has a much stronger, more positive effect on long-term Customer Lifetime Value.

Ready to Boost Your Shopify Store?

Increase revenue with video upsells and dominate search rankings with AI-powered SEO.

Related Articles

Creating Product Bundles In Shopify – Strategic Options

Create product bundles in Shopify by using an app. First, install the official Shopify Bundles app from the app store, or alternative apps such as Optizen Video Upsells. Inside the app, click “Create bundle” to begin. You then choose which products to include in your offer. Set a fixed price or a percentage discount, then […]

Finding Your Average Order Value in Shopify (And Why It Matters)

Find your Average Order Value (AOV) in your Shopify reports. Navigate to the Analytics section from your Shopify admin dashboard, then select Reports. Your store’s AOV is a key metric displayed on the main sales reports. You can also adjust the date range to analyze your AOV over specific periods. First, the easy part. To […]

Proven Methods To Increase AOV In Your Shopify Or Ecommerce Store

Increase average order value (AOV) by offering product bundles and volume discounts. Set a minimum spend threshold to unlock free shipping for customers. You can also upsell premium products and cross-sell related items in the cart. These strategies encourage shoppers to spend more, directly boosting your AOV. Let’s be honest, the whole game of running […]