Shopify Handles Your Sales Tax, Right? WRONG.

Shopify collects sales tax from customers at checkout based on your store’s tax settings. However, merchants are responsible for filing returns and remitting these collected funds to state and local governments. Shopify does not automatically remit taxes for you, unless you use the Shopify Tax service in eligible US states.

Let’s just get this out of the way. If you think Shopify deals with all your sales tax, you are in for a world of hurt. A really big one. Yes, it collects it at checkout, assuming you even set that up right. But you, the store owner, are the one who has to actually file the returns and give that money to the government.

Shopify doesn’t remit the tax for you. Not normally. Don’t let anyone tell you otherwise.

This is probably the biggest confusion point in all of e-commerce. Everyone just assumes the platform handles it. Nope. It hands you a calculator. That’s it. The legal disaster? That’s all yours. If you don’t grasp this simple fact, you’re looking at penalties that can sink your entire business. So, we’re going to drag you through this whole tangled mess.

How Shopify “Collects” Tax

So, does Shopify collect sales tax? Yeah, but in the most annoying way possible. The platform is pretty slick at doing the math when someone buys something. But what happens to the cash after that is where your real job begins. For a normal sale on your own store, Shopify is just a tube the money passes through. It is NOT the one writing a check to the state of Texas.

Think of it like this: the core Shopify service is just a glorified tax calculator. A customer hits checkout, the system peeks at their shipping address to see what state, county, and God-knows-what-else-district they’re in. Then, it checks the tax rules you, and you better have configured them, and slaps the right percentage on the cart total.

But here’s the kicker, the part everyone misses: Shopify just takes that tax money, throws it into the same pot with the money for your product and the shipping fee, and dumps the whole messy pile into your bank account. The tax money isn’t in some special, separate bucket. It’s just… in there. With your revenue. Which means you better be damn good at accounting, because you have to know exactly how much of that payout isn’t yours to spend. It belongs to the government. They give you the ingredients for staying legal, not legality itself.

And once Shopify hands you that pile of cash? The headache begins. You are the “seller of record,” which is just a fancy legal term for “this is your problem now.” You have to:

- Register with every single state you owe tax to.

- File their stupid tax returns on time.

- Actually SEND THEM THE MONEY.

You have to pull up your reports and figure out how much you collected for California, and maybe even for Los Angeles County specifically. Then, you find their form online, fill it out, and pay them. If you don’t send the money—even if you collected it perfectly—you’re basically stealing in the eyes of the state.

That “Shopify Tax” Service… It’s Not What You Think

To make this slightly less of a nightmare, Shopify does offer a paid thing called Shopify Tax. It’s got more bells and whistles. It’s more accurate, getting the tax rate right down to the specific rooftop. It even helps you figure out how weird stuff like clothing or digital downloads are taxed in different places.

But here’s the thing. Even if you pay for Shopify Tax… for almost everyone, you are STILL the one filing and remitting. The main benefit is just getting cleaner reports that make it easier for YOU to do the filing. In maybe one or two states, as a weird exception, they might file for you, but that is NOT the default. Don’t count on it.

And then there’s the “Shop Channel” to confuse you more

Just when you think you’ve got it, there’s this. There is ONE situation where Shopify acts like Amazon. If a customer buys your product through the “Shop” app or channel, then Shopify suddenly becomes a “marketplace facilitator.” And because of those marketplace laws, Shopify is legally required to collect AND remit the tax for that sale.

You have to track this. It’s critical. Sale inside the Shop app? Shopify handles it. Customer clicks a link in the Shop app that takes them to your website (yourbrand.com) to check out? The responsibility flips right back to you. You have to watch your orders like a hawk to see where they came from so you don’t double-pay tax that Shopify already took care of. Good luck.

A Quick and Dirty Guide to Sales Tax

Before you start clicking buttons in Shopify, you need to understand what this whole thing even is. Sales tax is a consumption tax. The customer pays it, but you’re the poor soul stuck with collecting it and mailing it in. For us online sellers, it’s a disaster because we could be selling to people in 50 states, each with its own dumb set of rules.

It’s a tax on stuff people buy, plain and simple. You add a percent to the price, hold onto that money for a bit, and then give it to the government. The rate is almost always based on where the package is going, not where you are. Why is it so hard? Because there are over 10,000 different tax jurisdictions in the U.S. Someone in Chicago isn’t just paying one tax; they’re paying a pile-up of state, county, city, and special district taxes. It’s a mess.

And don’t even think about ignoring it. States are hungry for this money and they are getting very, very good at finding online sellers who aren’t paying. They will make you pay all the back taxes you should have collected, hit you with insane penalties, charge you interest on everything, and can even shut you down. Just deal with it.

A few words you have to know:

- Nexus: The big one. A connection to a state that means you gotta collect tax there.

- Remittance: The act of sending the money to the state.

- Seller of Record: That’s you. The one who gets in trouble.

- Economic Nexus: The new-ish one. You can get nexus just by selling too much stuff into a state.

Nexus: The Thing That Decides Your Fate

The most important word in this whole conversation is “nexus.” You only collect tax in states where you have it. The hard part is figuring out where you have it.

It used to be simple: physical presence. An office, a warehouse, an employee. If your business is in Texas but you use a warehouse in Pennsylvania, guess what? You now have nexus in Pennsylvania and have to deal with their taxes.

But then e-commerce happened. A 2018 court case called South Dakota v. Wayfair changed everything. Now states can say you have “economic nexus” just for selling a certain amount to their residents, even with zero physical presence. The most common rule is $100,000 in sales OR 200 separate transactions in a year. Sell $110k to Californians from your office in Florida? Congrats, you have economic nexus in California now. You have to monitor your sales to every. single. state.

Okay, How Do I Set This Up in Shopify?

Once you know you have nexus in a state, you have to tell Shopify to start collecting.

Step 1: Figure out your nexus. Seriously. Don’t do anything else first.

Step 2: Get a sales tax permit. You CANNOT collect tax without being registered. It’s illegal. Go to the state’s Department of Revenue website and apply. They’ll give you an ID number.

Step 3: Go into your Shopify settings. Navigate to Settings > Taxes and duties. Find the United States. For every state where you got a permit, you have to click in and enter that Sales tax ID number they gave you. Once you do that, Shopify’s brain turns on and it starts calculating tax automatically for that state. You do this for every single state on your list.

Why Amazon Is Different (And Why It Confuses You)

People get so confused because Amazon just does all this for them. It’s because of those “marketplace facilitator laws.”

- Shopify is software. You build YOUR store. You are the “seller of record.”

- Amazon is a marketplace. It’s ONE store. They are the “seller of record.”

For sales on Amazon, they are legally required to calculate, collect, and remit the tax. It makes life easy. But that doesn’t apply to your own Shopify store. Shopify gives you the tools; Amazon takes the burden. They are not the same thing.

Using Your Data So You Don’t Go to Jail

After setup, your Shopify reports are your new best friend. Go to Analytics > Reports and find the Taxes report under Finances. It shows you exactly how much tax you collected, broken down by state or even county. This is the info you need for the tax forms.

When it’s time to file, you run that report, copy the numbers to the state’s online portal, and pay them. For the love of God, open a separate bank account and dump all the sales tax you collect in there. Don’t touch it. It’s not your money.

And remember, every state has a different filing schedule, monthly, quarterly, annually. Put it on a calendar. Missing a deadline, even if you owe $0, gets you a penalty. Keep records of everything. Forever. You’ll need them when, not if, you get audited.

Common Questions

Below are common questions we get asked.

How is Shopify different from Amazon on this?

Amazon is a marketplace, they remit the tax for you. Shopify is a platform for your own store, so it just collects the money and you have to remit it yourself. The responsibility is totally different.

What info does Shopify use to calculate tax?

The customer’s shipping address. That’s pretty much it. If it’s wrong, the tax will be wrong.

What do I do after Shopify collects the tax?

You file and you remit. That’s your whole job. You use the data from Shopify’s reports to fill out the state’s forms and send them the money you collected. On time. Every time.

Ready to Boost Your Shopify Store?

Increase revenue with video upsells and dominate search rankings with AI-powered SEO.

Related Articles

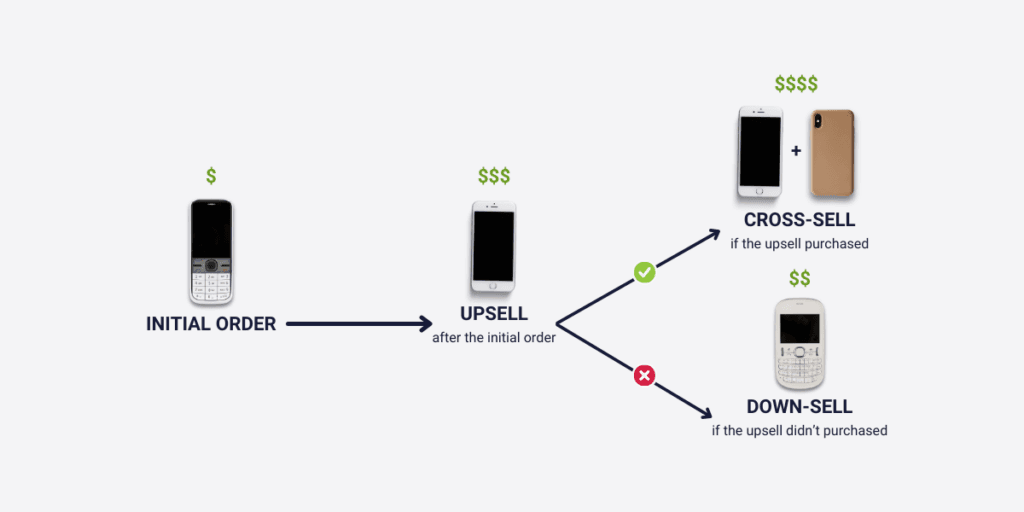

Difference Between An Upsell & Downsell? It’s About Unlocking Revenue and Customer Value

An upsell persuades a customer to purchase a more expensive, upgraded version of a product. This strategy increases average order value. A downsell offers a customer a lower-priced alternative after they decline the initial offer. This secures a sale that might otherwise be lost, recovering potential revenue. The whole idea is getting more revenue and, […]

Want to Upsell on Shopify and Actually Make More Money?

To upsell on Shopify, first install an upsell app from the App Store. Next, create specific offers that suggest a product upgrade. Display these offers directly on product pages, in the cart, or at checkout. You can also present post-purchase upsells on the thank you page for one-click acceptance. Okay, so how do you upsell […]

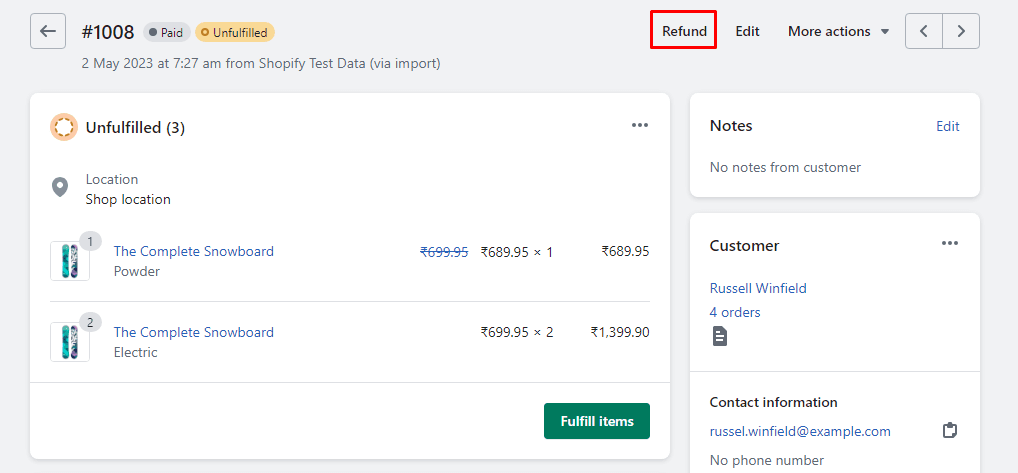

Shopify Refunds: The Real, Messy Scoop for Businesses

A Shopify refund takes 5 to 10 business days to appear in a customer’s account. When a store issues a refund, Shopify immediately sends the request to the customer’s bank. The bank then needs to process this transaction, which causes the delay. The exact timing can vary by bank. Look, you want the quick answer? […]