Percentage Of Sales – How Much Does Shopify Take?

Shopify takes a percentage of sales through transaction fees ranging from 0.5% to 2% for merchants not using Shopify Payments. Merchants using Shopify Payments do not pay transaction fees but still incur standard credit card processing fees.

Shopify is a leading e-commerce platform that provides businesses with the tools to build and operate online stores. A frequent question among merchants is:

Does Shopify take a percentage of sales?

Yes, it does. The percentage Shopify charges depends on the payment method used, subscription plan, and whether the transaction involves international payments.

This guide breaks down how Shopify’s transaction fees work, compares Shopify Payments to Third-Party Payment Providers, and offers tips for reducing costs. Understanding these fees is essential for optimizing your revenue.

How Shopify Charges Fees on Sales

Shopify Payments (Preferred Method)

What is Shopify Payments?

Shopify Payments is Shopify’s integrated payment processing system, allowing you to accept payments without relying on external gateways like PayPal or Stripe. Using Shopify Payments eliminates additional transaction fees beyond standard credit card processing.

Transaction Fees by Plan:

- Basic Plan: 2.9% + $0.30 per online transaction.

- Shopify Plan: 2.6% + $0.30 per online transaction.

- Advanced Plan: 2.4% + $0.30 per online transaction.

Why Use Shopify Payments?

- No additional transaction fees.

- Integrated dashboard for simplified financial tracking.

- Fast payouts directly to your bank account.

Third-Party Payment Providers (Alternative Method)

What Are Third-Party Providers?

Third-party payment providers like PayPal and Stripe are external gateways integrated with Shopify. If you choose not to use Shopify Payments, additional transaction fees apply.

Additional Fees by Plan:

- Basic Plan: 2.0% per transaction.

- Shopify Plan: 1.0% per transaction.

- Advanced Plan: 0.5% per transaction.

Pros:

- Offers more flexibility by allowing various payment processors.

- Potentially lower fees for certain providers.

Cons:

- Shopify adds extra transaction fees.

- Can complicate payment tracking and reporting.

Currency Conversion Fees

If you sell products internationally and receive payments in multiple currencies, Shopify applies a currency conversion fee when converting funds to your payout currency.

Currency Conversion Fees:

- United States: 1.5% per transaction.

- Other Regions: 2.0% per transaction.

These fees are added to your regular transaction fees, so it’s essential to account for them if you’re targeting global markets.

In-Person Sales (POS System)

Shopify also supports in-person sales via its Point of Sale (POS) System. This option is popular for retail stores using Shopify as their primary business platform.

POS Transaction Fees by Plan:

- Basic Plan: 2.7% per transaction.

- Shopify Plan: 2.5% per transaction.

- Advanced Plan: 2.4% per transaction.

The POS system allows you to seamlessly process transactions in physical locations. Its fees are lower compared to online transactions.

Comparison of Shopify’s Transaction Fees

Fee Breakdown Table (Quick Reference)

| Plan Type | Shopify Payments (Online) | Third-Party Providers (Additional Fee) | POS System (In-Person) |

|---|---|---|---|

| Basic | 2.9% + $0.30 per transaction | 2.0% per transaction | 2.7% per transaction |

| Shopify | 2.6% + $0.30 per transaction | 1.0% per transaction | 2.5% per transaction |

| Advanced | 2.4% + $0.30 per transaction | 0.5% per transaction | 2.4% per transaction |

Pros and Cons of Using Shopify Payments

Benefits:

- Avoids extra transaction fees.

- Integrated with Shopify’s dashboard for easy management.

- Fast processing and payouts.

Drawbacks:

- Limited availability in certain countries.

- May not provide the flexibility of external providers.

How Shopify’s Fees Impact Your Business

Cost Analysis by Business Model

Shopify’s transaction fees can affect your revenue significantly, depending on your business model. Key considerations include:

- Low-Volume Sellers: Using Shopify Payments is ideal for minimizing transaction fees.

- High-Volume Sellers: The Advanced Plan offers the lowest transaction fees, making it the most cost-effective option for large sales volumes.

- International Sellers: Currency conversion fees can be costly. Choosing a plan with favorable terms can help reduce losses.

Optimizing Your Payment Strategy

To minimize transaction fees, consider these strategies:

- Use Shopify Payments: Avoid additional fees and simplify your transaction process.

- Compare Providers: Evaluate external payment processors to see if their rates are more favorable.

- Review Your Plan: Upgrade to a higher-tier plan if your sales volume justifies it.

Popular Questions

Below are common questions we get asked about this topic.

Why Does Shopify Charge Transaction Fees?

Yes, Shopify charges transaction fees to cover the cost of maintaining its platform and processing payments. By using Shopify Payments, you can eliminate additional transaction fees that would apply if you used third-party providers like PayPal or Stripe.

How Can I Avoid Shopify’s Transaction Fees?

To avoid Shopify’s transaction fees, use Shopify Payments. When you use Shopify Payments, you only pay standard credit card processing fees, which vary based on your subscription plan. Additionally, you can reduce fees by choosing the Advanced Plan, which offers the lowest transaction costs for high-volume sellers.

What Happens If I Use a Third-Party Payment Processor?

When you use a third-party payment processor like PayPal or Stripe, Shopify charges an extra transaction fee on top of the provider’s processing fees. This fee depends on your subscription plan:

– Basic Plan: 2.0% per transaction.

– Shopify Plan: 1.0% per transaction.

– Advanced Plan: 0.5% per transaction.

Using Shopify Payments is the only way to avoid these additional fees.

Is Shopify Payments Available Worldwide?

No, Shopify Payments is not available in all countries. It is primarily available in countries like the United States, Canada, United Kingdom, Australia, and several European countries.

To check if Shopify Payments is available in your region, visit Shopify’s official list of supported countries.

How Much Does Shopify Charge Per Sale for International Payments?

If you sell internationally and accept payments in multiple currencies, Shopify applies a currency conversion fee when converting funds to your payout currency.

– United States: 1.5% per transaction.

– Other Regions: 2.0% per transaction.

These fees are applied in addition to standard transaction fees.

Conclusion

Shopify does take a percentage of sales, but the amount depends on your subscription plan, payment method, and whether you sell internationally. To reduce costs, consider using Shopify Payments whenever possible and regularly reviewing your plan to ensure it aligns with your sales volume.

Ready to Boost Your Shopify Store?

Increase revenue with video upsells and dominate search rankings with AI-powered SEO.

Related Articles

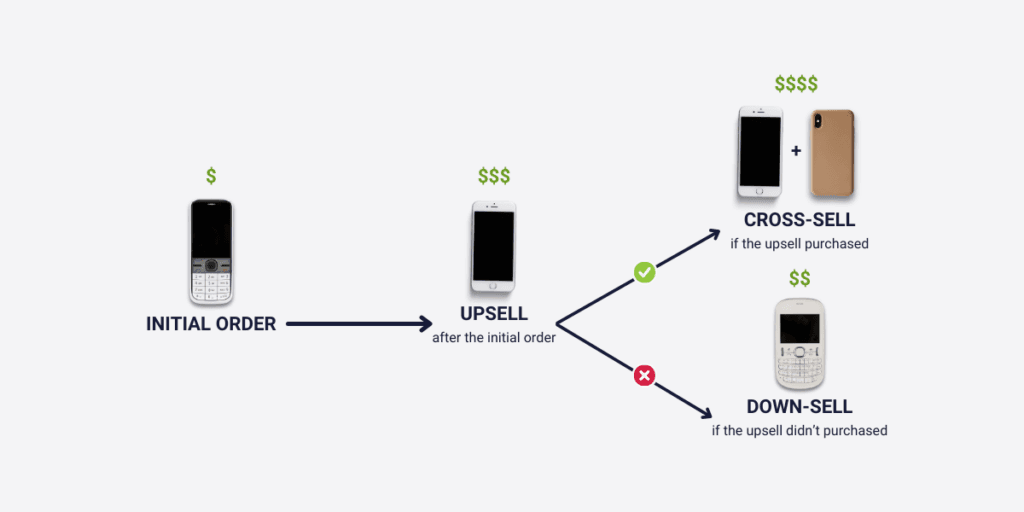

Difference Between An Upsell & Downsell? It’s About Unlocking Revenue and Customer Value

An upsell persuades a customer to purchase a more expensive, upgraded version of a product. This strategy increases average order value. A downsell offers a customer a lower-priced alternative after they decline the initial offer. This secures a sale that might otherwise be lost, recovering potential revenue. The whole idea is getting more revenue and, […]

Want to Upsell on Shopify and Actually Make More Money?

To upsell on Shopify, first install an upsell app from the App Store. Next, create specific offers that suggest a product upgrade. Display these offers directly on product pages, in the cart, or at checkout. You can also present post-purchase upsells on the thank you page for one-click acceptance. Okay, so how do you upsell […]

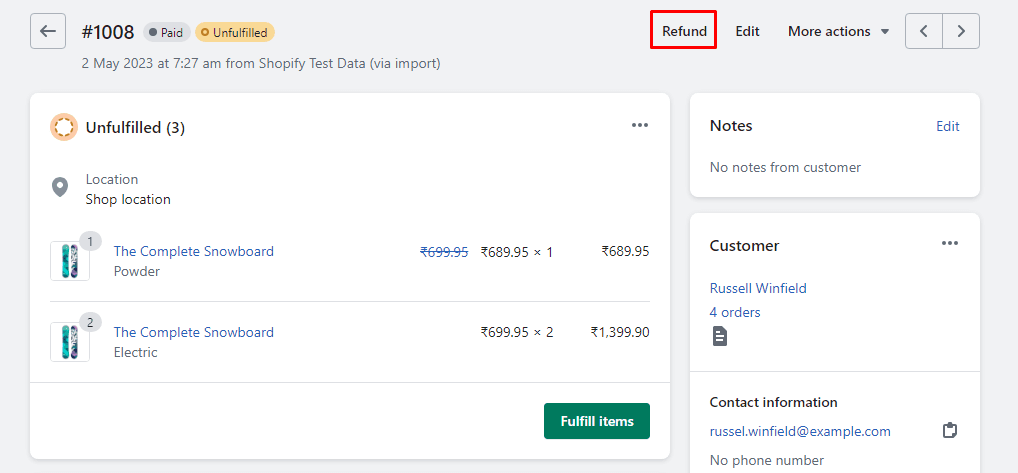

Shopify Refunds: The Real, Messy Scoop for Businesses

A Shopify refund takes 5 to 10 business days to appear in a customer’s account. When a store issues a refund, Shopify immediately sends the request to the customer’s bank. The bank then needs to process this transaction, which causes the delay. The exact timing can vary by bank. Look, you want the quick answer? […]